What share of all chips are high-end data center AI chips?

In this post, we try to estimate what fraction of all chips were high-end data center AI chips in 2022. When discussing compute governance measures for AI regulation, it is crucial to precisely define the scope of any such measures to prevent regulatory overreach and counterproductive side effects.

by Lennart Heim and Konstantin Pilz.

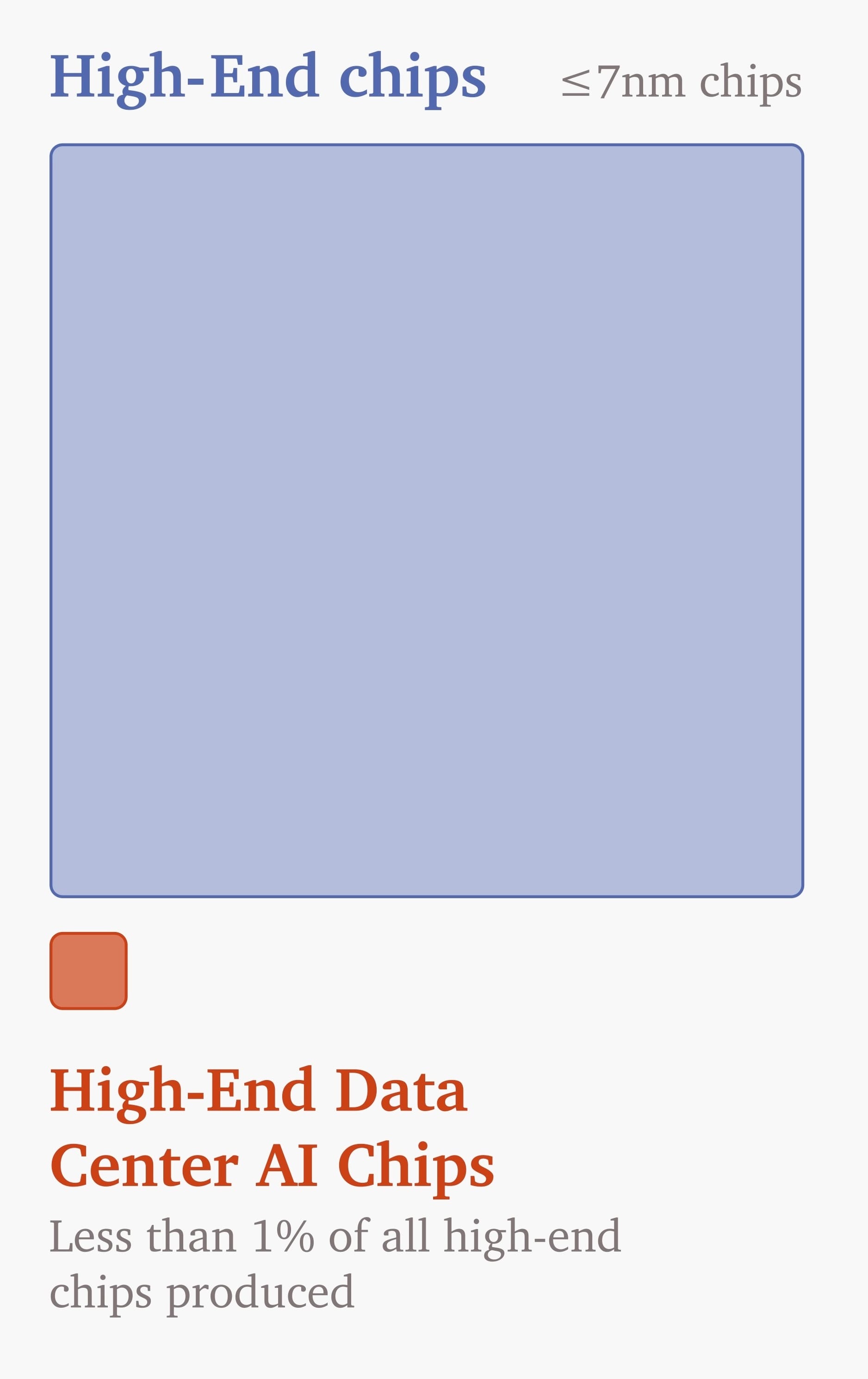

Share of data center AI chips of high-end chips

Nvidia reported a revenue of $15B from its data center segment in 2022 (NVIDIA, 2023). For an upper bound on the number of 7nm chips NVIDIA sold (<7nm chips such as the H100 were not yet available in 2022), we assume this entire revenue was generated from the sales of 7 nm chips used in data centers, each priced at $10,000, the current market price for the A100 (Leswing, 2023). (This is an upper bound because NVIDIA also sold >7nm data center chips such as the V100 in 2022 and likely sold a significant share of their 7nm chips as part of integrated products, which are priced significantly higher.) This calculation provides an upper limit of approximately 1.5 million 7nm data center chips sold by NVIDIA in 2022.

Considering that NVIDIA made up about 80-95% of the data center AI accelerator market (Nellis & Mehta, 2023), we conservatively estimate the total number of high-end data center AI chips sold in 2022 to be lower than 3 million, even when accounting for ≤7nm AI accelerators that are not being sold, such as Google’s TPUs.

TSMC alone reportedly produced more than one billion 7nm chips between April 2018 and August 2020 (TSMC, 2020), indicating an average annual production of more than 333 million 7 nm chips per year. (TSMC has not published more recent numbers on their 7nm production capacity, though they state that production efficiency and yield continue to increase, indicating a higher number of 7nm chips produced in 2022.)

Therefore, we conclude that high-end data center AI chips likely constituted far less than 1% (3M/333M) of all 7 nm chips produced in 2022.

Note: We only estimate an upper bound for the fraction of high-end chips that are data center AI chips. Precisely estimating the number of high-end chips is challenging due to even more limited data availability. For our purposes, we focus exclusively on 7nm capacity, as there were no data center AI chips using < 7nm nodes. However, to estimate the number of all high-end chips, we would also need to include more advanced nodes, such as 5nm. The most advanced nodes are typically used in energy-efficient devices with smaller die sizes (e.g., smartphones), resulting in a higher yield and more chips per wafer. Due to these factors, we cannot estimate the overall market share of high-end chips among all chip production. However, we are able to provide an estimate for the share of high-end AI data center chips in the total high-end chip production.

Additionally, the die size of AI chips is considerably larger than that of most consumer chips, such as smartphone processors. Therefore, if assessing the total production in terms of processed wafers rather than produced chips, AI chip production would make up a larger share of total production.

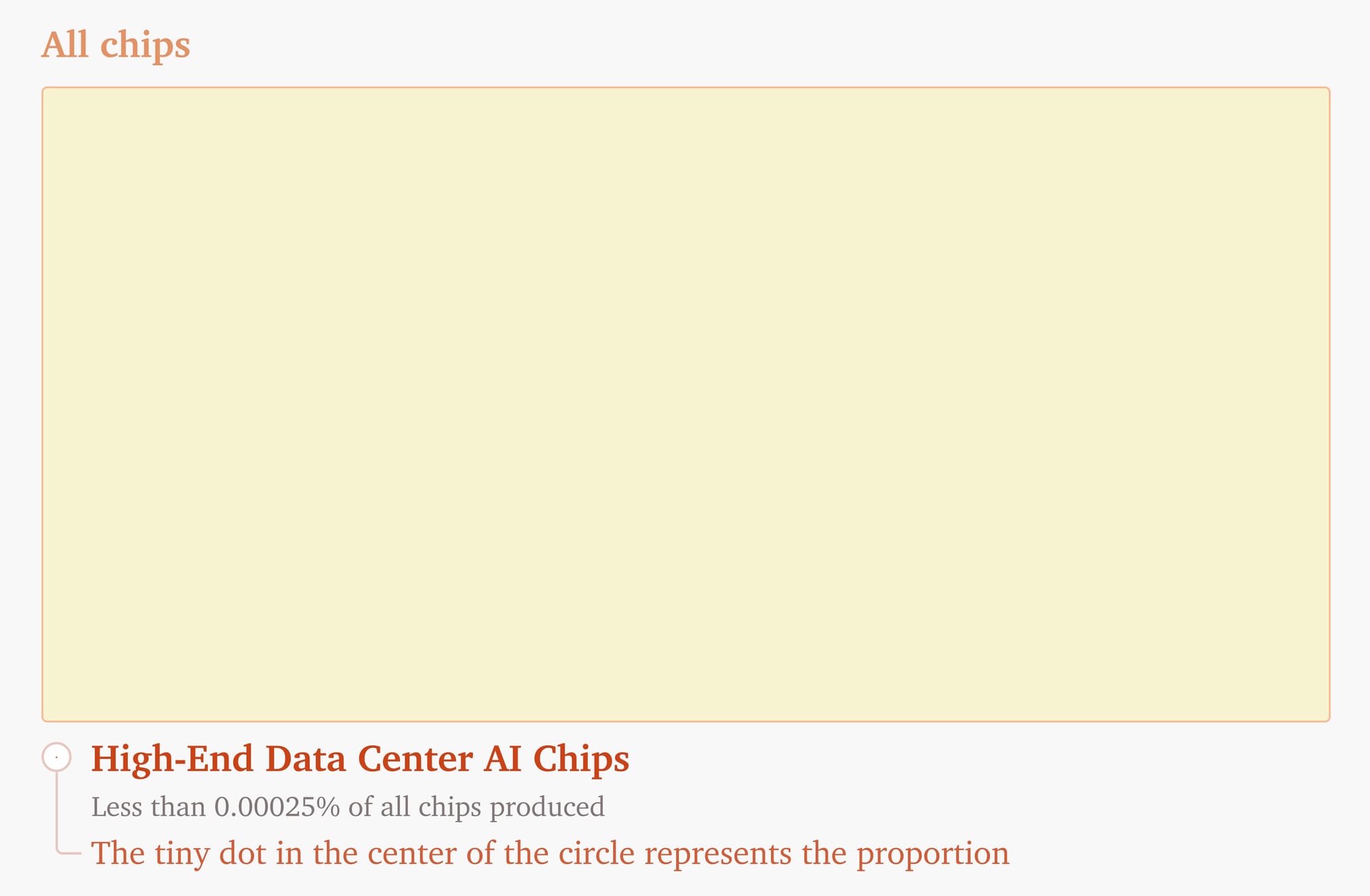

Share of data-center AI chips of all chips

In 2021, the semiconductor industry reportedly produced about 1.15 trillion units (Kharpal, 2022). As calculated above, the production of high-end AI chips in 2022 was likely less than 3 million. This suggests that high-end AI chips only accounted for less than 1:4,000 (0.00026%) of all chips produced.

Given the current AI accelerator demand (D. Clark, 2023), the total production of AI accelerators will likely increase considerably over the coming years. However, even if the total production increased by 10x or 100x, the fraction of total chips would only increase to 1 in 400 and 1 in 40, respectively, indicating AI chips would still constitute only a small fraction of all chips.